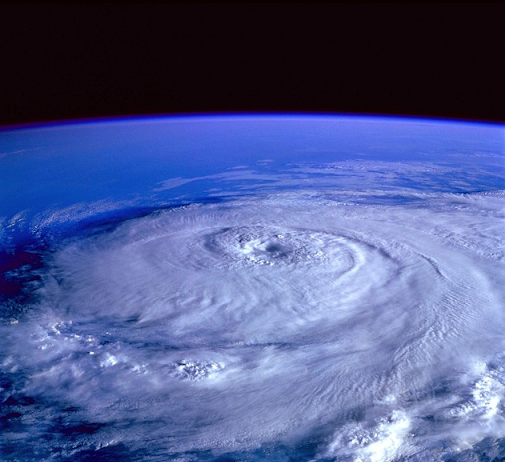

Hurricane season is upon us, and experts are predicting a very busy season. NOAA predicts a 70% chance of 14-21 named storms, with 2-5 of them being major hurricanes. As this article is being written, category 3 Hurricane Idalia is barreling into Florida’s Gulf Coast, disrupting millions of lives...

In the global rush to produce Electric Vehicles, many battery manufacturers have relied on cobalt to improve the performance of batteries.

Cobalt has a wide variety of industrial applications

1. Aerospace and Defense: Cobalt-based alloys are used in jet engines and gas turbine components due to their high-temperature...

Welcome to this special Tactical Tuesday edition of Global Investment Daily! If you thought last week was a whirlwind, grab onto something because things are really heating up. The recent market swoon is sending shockwaves beyond mere 'volatility'. It's a wake-up call for those who thought the bull run...

The last decade provided a pretty wild yet exciting ride for exchange-traded funds (ETFs). From the ETF industry crossing the $4B mark in AUM (assets under management) and the meteoric rise of ESG (Environmental Social and Governance) investing to the SEC approving the first-ever non-transparent, actively managed ETFs last...

As the second most abundant element in the Universe behind only hydrogen, it’s ironic--and somewhat maddening--that helium is also one of the rarest elements on earth. In our atmosphere, helium occupies just 5.2 parts per million (ppm), earning the designation of a ‘rare’ gas thanks to one of its...

Since 2020, we have all felt the impact of inflation in our lives. We’ve felt the rising costs of gasoline, eggs, meat, rent and other daily necessities.

Interest rate hikes, designed to cool down runaway inflation. Whle interest rates surged from under 3% to 6.5%, new 30-day mortgage interest rates...

The price of gold has skyrocketed over the past few months, moving up from $1,600 to over $2,000 per ounce, in increase of 25 percent.

With the recent turmoil in the banking industry, cryptocurrencies and continued inflationary pressure, investors are flocking to gold as a safe haven.

As the price of...

A historical event without precedent in living memory, the COVID-19 pandemic has affected the commodity markets, including metals and mining, in a variety of ways with many miners experiencing the downside of relying on global supply chains, specialization and ultra-lean operations.

Many mining operations have been disrupted through government-mandated shutdowns...

2024 has the potential to emerge as a banner year for the semiconductor stock sector, fueled by a convergence of factors that promise to reshape the industry landscape.

With increasing demand for advanced electronic devices, the continued expansion of 5G networks, and the proliferation of artificial intelligence applications, semiconductor companies...

The COVID-19 crisis has packed a big wallop to the global economy that will likely be felt for years to come. Back in June, the World Bank sounded the alarm that the crisis was likely to plunge the economy into the worst recession since WWII. The dire warning has...