Global Investment Daily Featured Stock: Hims & Hers Health Inc.

In the labyrinth of financial markets, where the allure of fast-paced tech stocks often overshadows the steady drumbeat of more traditional sectors, healthcare stocks tend to whisper rather than shout for investors’ attention.

Traditionally viewed as the tortoises in a race...

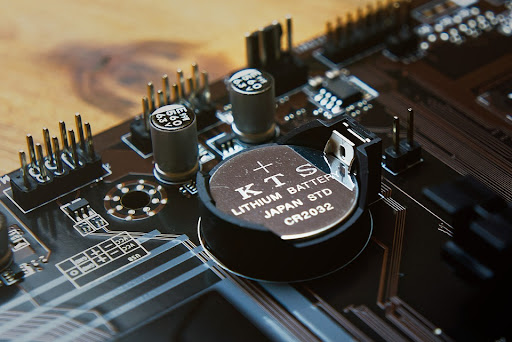

In a surprise move that shocked global markets, Chile, which has about 40% of the world’s known lithium reserves, announced it was proposing a plan to nationaliize production of the rare earth metal - a key component in EV battery production.

Almost immediately, lithium mining stocks nose-dived. Albemarle Corp (ABM)...

The Fed is at a crossroads. Higher egg prices could be a warning sign for what’s next.

Egg prices are soaring again—and they’re more than just a grocery-store nuisance. They’re becoming a symbol of the Federal Reserve’s growing challenge in controlling inflation. With costs for a dozen eggs surging 62.3%...

Rally or Reversal? CPI Holds the Answer

As 2024 winds down, the markets are buzzing with optimism. Stocks are climbing, cryptocurrencies are soaring, and even the Federal Reserve seems poised to ease the reins on interest rates. But don’t get too comfortable just yet—the November Consumer Price Index (CPI) report,...

When it comes to delivering oil to the market, the traditional approach has involved heavy investments in exploration and drilling. The problem with this approach is that not all exploration projects are timely or profitable. And in today’s push for clean energy, exploration and drilling is often frowned on...

Why is the market so resilient, yet so vulnerable? In recent weeks, investors witnessed a brief but sharp sell-off that left many scratching their heads. The stock market's rapid rebound, despite concerning economic signals, has sparked debates about the underlying health of the global economy. Deutsche Bank's latest analysis...

The Market Is Up. But Should You Be Nervous?

If May taught investors anything, it’s that a market can climb even with turbulence rumbling underneath. With the S&P 500 chalking up its best month since November 2023, equities stormed into June flirting once again with record territory. But like a...

Welcome to this week's edition of The Market Pulse, where we look into the most pressing trends and pivotal moments right now in the markets. This week, we're poised on the edge of a potential major shift in the market dynamics. With economic data taking center stage, the spotlight...

In the race to build a new generation of electric vehicles, the demand for certain rare earth minerals has skyrocketed.

Two critical rare earth minerals are Germanium and Gallium, and China is the largest supplier of these minerals. We covered the industrial applications of these minerals in a recent Global...

Ready for Tactical Tuesday? Today, we're zeroing in on the Dow Jones Industrial Average and its tantalizing approach to the 40,000 mark. It seems that the wall of investor psychology has it playing hard to get. But history suggests a breakthrough could mean above-average performance for the Dow!

Speaking of...