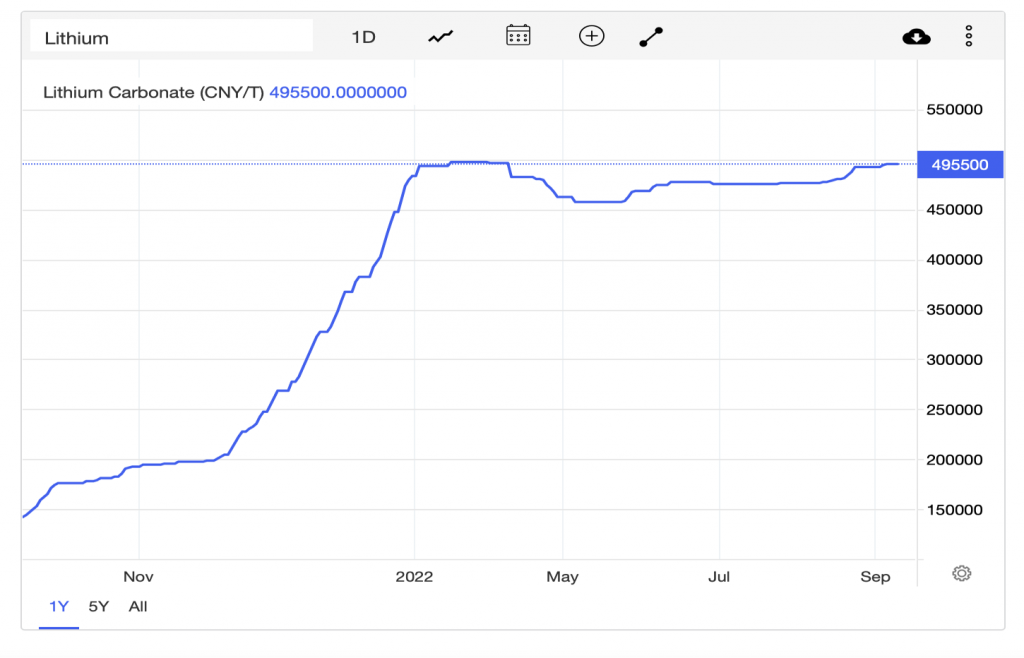

Auto giants around the world are gearing up to pour over half a trillion dollars into EV and battery technology initiatives. In order to meet the high North American demand, new lithium sources must be secured and brought online. This provides clarity as to why lithium prices are up 400% year-over year and continue to hit record highs. A new wave of North American developers now holds the key to tighten the ever-widening supply deficit of this metal.

Global EV sales surge prices are expected to continue to accelerate until a sustainable domestic solution in put in place. This has created a mad dash to secure North American assets and supply options. A recent trend has seen offtake agreements being struck as soon as new resources are on the horizon.

Biden’s $750-billion Inflation Reduction Act (IRA) is now tipping the balance even further. It’s a policy package that makes batteries, battery metals and EVs wildly more attractive.

And this is a major inflection point for automakers …

The lithium market is expected to double by 2030, EV automakers are reporting a record level of growth that challenges suppliers to keep up with the intense demand.

Ford’s Q2 earnings call was a wakeup for the industry, when CEO Jim Farley said, “we’re selling them [EVs] as fast as we can make them”, and the giant is now gunning for production of 600,000 EVs by the of 2023 and 2 million in 2026.

All major manufactures are scrambling to secure significant quantities of these raw materials; and Canada is primed to address the supply shortage.

Volkswagen AG and Mercedes-Benz Group AG have reportedly sealed agreements with Canada to secure access to lithium for battery production, according to people familiar with the accords.

No metal on Earth underpins the energy transition more than lithium.

But now, origin is the kingmaker and national security is the name of the game.

That lends a particular advantage to lithium companies operating in North America, and in the race to the finish line, investors will be looking to back those junior E&P innovators who are furthest along.

Since development takes time, investors need to select early entrants who promise the fastest and biggest impact on the supply side. With the recent macro volatility in the global markets, Lithium E&P investments has been one area where some investors have been able to seek positive returns.

EV Investors have been rewarded handsomely with early investments into companies such as:

Lithium America’s ($4.3 Billion mkt cap)

Sigma Lithium ($2.8 Billion mkt cap)

E3 Lithium ($150 Million mkt cap)

Lithium Ionic ($121.0 Million mkt cap)

Standard Lithium ($865 Million mkt cap).

(values as of Sept 19, 2022)

Now a new wave of entrants into the space look to capitalize on this international movement, and investors are size up which companies to back.

Canadian based EMP Metals Corp (CSE:EMPS) (OTC: EMPPF) could begin to gather meaningful traction in the coming quarters as it ticks three important boxes:

First, it’s an early entrant which has operations in Canada’s Saskatchewan region, a prolific lithium zone and one of North America’s best chances to reduce its dependence on China for supply.

Second, EMP holds critical mass with over 212,000 acres and 37 lithium-brine permits.

Third, this junior explorer is already in the middle of an aggressive drill campaign–with impressive concentrations of lithium and flow tests from the first test well on its Mansur Permit Area.

As momentum picks up here, the rest of the year could see a fast-moving flow of news, with results from a second well in its Tyvan Permit Area, spudding of a third in its Viewfield Permit Area and re-entry of a second well in its Mansur Permit Area towards building a PEA (preliminary economic assessment).

Why Junior Miners Are the Key to New Lithium

Fitch sees lithium prices remaining “extremely” elevated this year and next as battery demand and tight upstream supply pile on constraints. Tesla and Elon Musk are being proactive as the company is exploring a lithium refinery business to satisfy its demand according to recent Barron’s article. The facility will be the first of its kind in North America with construction set to begin in 2022 and production as early as 2024.

Chinese lithium carbonate will average around $68,000/t this year, up from under $19,000/t in 2021.

And demand for lithium is now unstoppable, while supply is well short. This year has already seen an over 83% surge in demand, year-over-year.

Fitch forecasts the lithium supply deficit will widen from 259,000 tonnes this year to 329,000 tonnes next year.

Benchmark Mineral Intelligence estimates that we will need $42 billion in investment into the lithium sector in order to meet 2030 demand. Benchmark expects that demand will reach 2.4 million tonnes (lithium carbonate equivalent) by 2030–a figure that dwarfs 2022’s production estimate of only 600,000 tonnes.

This is a prime setup for junior lithium explorers to attract investment in a sector where new supply options have reached a desperate inflection point.

Fitch Solutions’ data shows only four new lithium mines coming online this year. All together, they offer new capacity of only 75,000 tonnes. In 2023, only 11 projects are scheduled to start.

North America is the ideal jurisdiction for this emerging industry and Canada could be at the top of the list given their access to key metals and minerals that can potentially support the battery supply chain according to Clean Energy Canada . Canada holds some of the largest known reserves of rare metals in the world and the government is doing its part through supportive ESG policies and initiatives. Thus, providing Lithium explorers tools to succeed at home and bring new critical supply options to market.

Canadian Lithium companies have attracted the attention of investors as they seek to avoid political risks common in many international jurisdictions where the metal is currently sourced. The ESG movement has hit the radar of investors as they keenly search for new plays to back.

EMP Metals (EMPS.CA) is racing to emerge as a leader within the Canadian market with impressive highlights from its 2022 drilling campaign:

- Flow results from EMP’s first well impressed investors in the Mansur Permit Area with concentrations of up to 96.3 mg/l

- At its Tyan Permit Area, EMP acquired a second wellbore from Epping Energy Inc. for lithium testing

- They pinpointed a high-priority target location for a test well in the Viewfield Permit Area

- EMP commenced re-entry of the Epping wellbore for testing

- The company also signed an agreement for testing lithium extraction

- Fully financed – a ~C$2.5-million raise was secured to continue its aggressive exploration and development campaign across its over 212,000 acres.

Saskatchewan: North America’s Biggest Bet on Domestic Lithium

Canada’s Saskatchewan stands to become one of the most important lithium hubs in North America, if not the world.

This is already a top area for other critical minerals, including uranium, potash and helium. And it’s known to be rich in the battery metals that auto giants now covet more than anything: lithium, graphite, nickel, cobalt, aluminum and manganese.

In fact, Saskatchewan is home to 23 of the 31 critical minerals identified by the Canadian government, and it’s wildly underexplored.

It’s the perfect North American hub for battery metals.

The province’s Duperow formation is a hot bed of lithium exploration, with a lineup of high-grade discoveries. It’s also where EMP has acquired over 212,000 acres for its current drilling campaign.

Further confirmation of Duperow’s prospects, EMP Metals maiden well at its Mansur property returned lithium concentrations up to 96.3 mg/l.

The potential margins are attracting drillers to this formation in particular because it is known to have exceptionally high grades of lithium at shallower depths than the Leduc formation of the Alberta basin. That means there is potential for “direct lithium extraction” (DLE), which significantly lowers costs and improve margins that are potentially double of those that require hard-rock extraction.

Early Entrants, Fast Movers

North America could be running out of time, and that means tax incentives, government funding potential and investors on the prowl for juniors that can cross this finish line.

Early entrants have a clear advantage–those with drill bits already in the ground and multi-well drill campaigns well underway.

Investors are looking for news flow and want to see real momentum because whoever crosses the finish line first could be met with lucrative offtake and supply agreements with auto giants and EV battery gigafactories that anxiously await.

So, what comes next for EMP Metals Corp?

So far, the news flow appears to be gaining momentum, with a lineup of drilling, re-entries and results to set the stage for preliminary economic assessments.

EMP’s key objectives for the rest of this year promise a steady news flow and include:

- Lithium concentration results from its Epping test well

- The acquisition of 2 newly identified high-priority wellbores for test at its Mansur Permit Area

- Spudding, casing and concentration and flow testing at its first well at the Viewfield Permit Area

- Re-entry and flow-testing of an additional well at Mansur for a Preliminary Economic Assessment

- Securing of a formal development plan with a lithium extraction technology partner to develop a commercial processing facility

The Lithium Inflection Point

Currently, most of the world’s lithium comes from Chile, Australia and China, with less than 1% produced in the United States, which has only a single mine–in Nevada. Canada appears to be emerging as North America’s best chance for lithium, and its best chance to tackle key battery metals from a national security perspective.

Both Canada and U.S. are fully on board with incentivizing lithium explorers and anything along the domestic battery supply chain, including tax breaks for mines.

That means potentially very attractive margins for (CSE:EMPS) once it proves up a discovery–and it’s further along than many new plays, with success in its maiden drill and a steady flow of drilling and results expected for the rest of this year and next.

The endgame here is large scale DLE on over 212,000 acres in prime Saskatchewan lithium territory. Direct lithium extraction is an important aspect here–not just for the ease and the economics, but for the energy transition itself. DLE reduces the surface environmental footprint by about 90%-95%, employing highly selective absorbents to extract lithium from brine water using geothermal or renewable energy sources. This social conscious approach goes along way in today’s ESG environment. A potential large-scale discovery in a play with this type of environmental setup, will be watched by those on the hunt for new lithium acquisitions ready to develop into production.

** IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. Fortyfive Media and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by EMP Metals Corp. (CSE: EMPS) (OTC: EMPPF) to conduct investor awareness advertising and marketing. EMP Metals paid the Publisher to produce and disseminate this article and related banner ads for forty thousand dollars. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by EMP Metals) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.